Hyperliquid: The 11-Person Exchange That Shows How Extreme AI-Era Efficiency Can Get

What a tiny crypto derivatives team can teach us about the future of AI, agents, and software leverage

If you want to understand where AI and automation are taking the economy, you do not need a research paper.

You can look at Hyperliquid.

Hyperliquid is a fully on-chain crypto derivatives exchange running on its own Layer-1 blockchain, with roughly 11 core contributors and about 1.2 billion dollars in annualized protocol revenue.

That works out to around 106 million dollars per person.

More than Tether per head. Far above Apple, Nvidia, Coinbase, or NASDAQ.

Hyperliquid is not marketed as an “AI company,” but it already operates like the kind of AI-native business people keep predicting: a small team, an automated system, and a product that scales without adding humans.

In AI terms, it is what happens when you replace departments with code and treat the exchange itself as a giant agent.

Let’s break down how it works, where the efficiency comes from, and what it implies for AI founders and investors.

1. Business model: code as the operating team

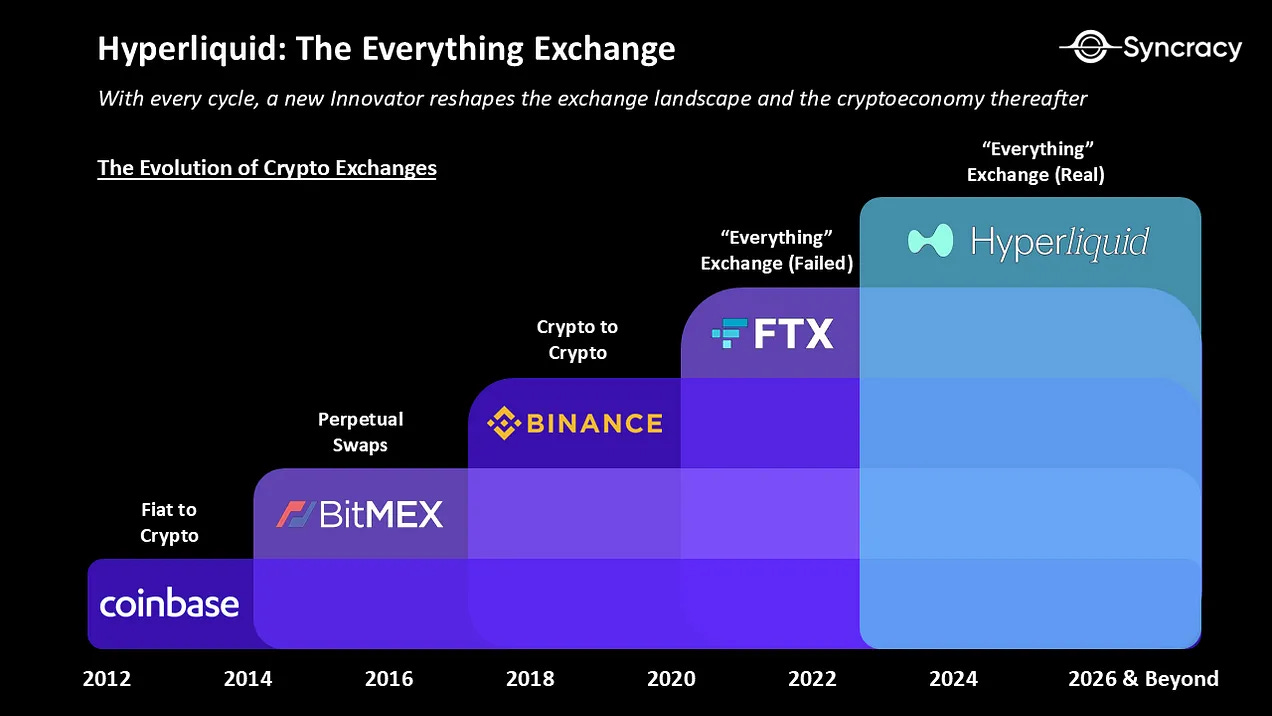

Hyperliquid is a decentralized exchange focused on one product: perpetual futures.

It runs a central limit order book (CLOB) on its own Layer-1 and charges a fee on every trade. The model is identical to traditional exchanges like Binance or CME, but almost everything that used to be done by people is now done by software.

There is:

No custodial back office

No internal market-making desk on payroll

No large customer support organization

No operations floor overseeing settlement

Market makers, funds, and individual traders connect directly to the protocol. The code handles:

Order intake

Matching and risk

Margining and liquidations

Settlement on-chain in real time

As of mid-2025:

Protocol revenue is about 1.17 billion dollars annualized

Team size is 11 people

Revenue per employee is around 106 million dollars

Fees flow into:

The protocol treasury

HYPE token incentives and buybacks

Insurance funds that backstop liquidations

This is what “software leverage” looks like when you commit to it. The company layer is extremely thin, and almost all of the work is done by a machine.

Trading engine and payments rail in one

Hyperliquid designed the system around stablecoins.

Margin, settlement, and transfers are in USDC, USDT, and similar assets. The L1 is tuned to move stablecoins fast and cheaply.

That does two things:

Makes the exchange attractive to professional traders who care about capital efficiency and low latency.

Turns Hyperliquid into a stablecoin settlement rail for payments, payroll, and invoicing.

Businesses can hit the APIs and move money globally with near-instant finality, using the same rails that power trading. A chunk of the roughly 330 billion dollars in annual transaction volume is likely non-speculative stablecoin flow riding on this infrastructure.

The pitch is simple and powerful: CEX-like performance, DeFi custody, and a programmable payments network, all driven by software, not staff.

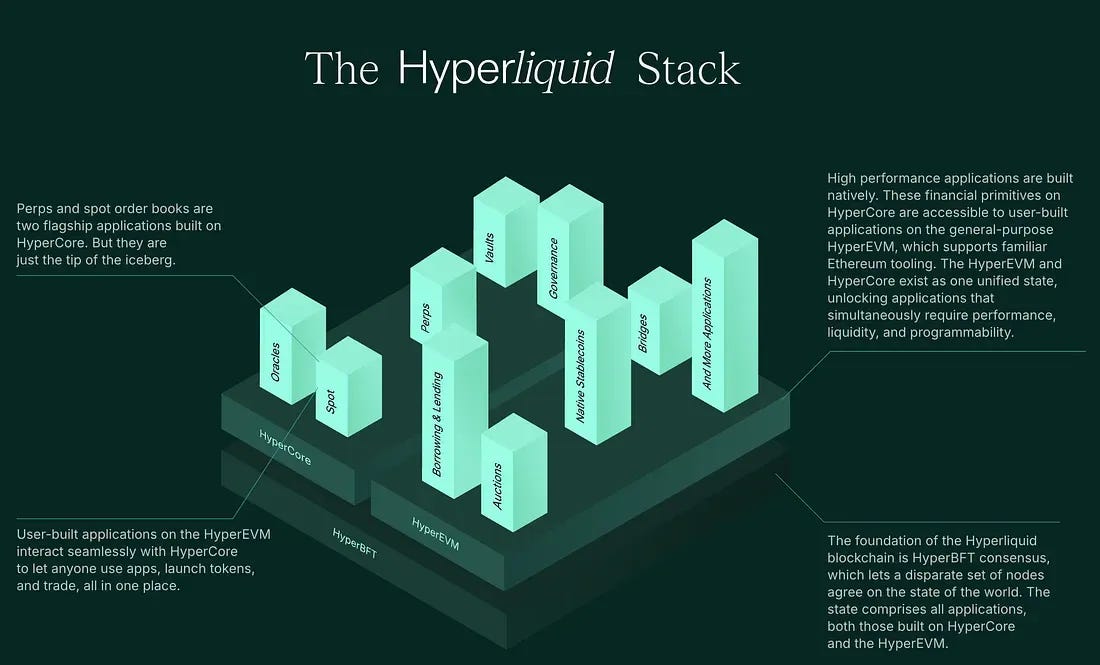

2. Technical architecture: a chain that behaves like an AI agent for trading

Most DeFi protocols deploy as smart contracts on a general-purpose chain. Hyperliquid built the chain around the exchange.

Hyperliquid L1, HyperBFT, HyperCore

The core:

Hyperliquid L1 – a custom blockchain designed for low-latency trading

HyperBFT – a BFT consensus protocol with sub-second finality

HyperCore – an execution engine that embeds the entire CLOB and matching logic inside the state machine

Every order placement, cancel, and trade is a transaction that gets sequenced by consensus and applied by the engine. The blockchain itself is the matching engine and risk system.

That brings two key properties:

Transparency. Any node can see full depth of book and full trade history at every block.

Predictable performance. There is no off-chain dark order flow or hidden matching logic.

Reported performance:

More than 200,000 transactions per second capacity

Around 0.2 second average confirmation

Full-market data on-chain

From an AI and systems point of view, this looks like a specialized reasoning and execution engine. It ingests a large stream of “actions” (orders), runs them through deterministic logic, and continuously updates a shared world state (positions and balances), with no human in the loop.

Gasless UX

Traders do not pay on-chain gas for orders. They only pay trading fees on execution.

Validators absorb gas costs and are compensated via protocol economics. This design is crucial if you want agents, bots, and quant strategies to hit the chain at high frequency.

HyperEVM and ecosystem leverage

In 2025, Hyperliquid launched HyperEVM, an Ethereum-compatible VM running on the same hardware.

Now developers can deploy Solidity contracts into the Hyperliquid environment.

Early examples include:

Felix, a CDP-style stablecoin protocol

HyperLend, a lending market

In AI language, Hyperliquid is turning itself from a single “agent” (the exchange) into a platform for other agents and workflows to live on top of its high-performance state machine.

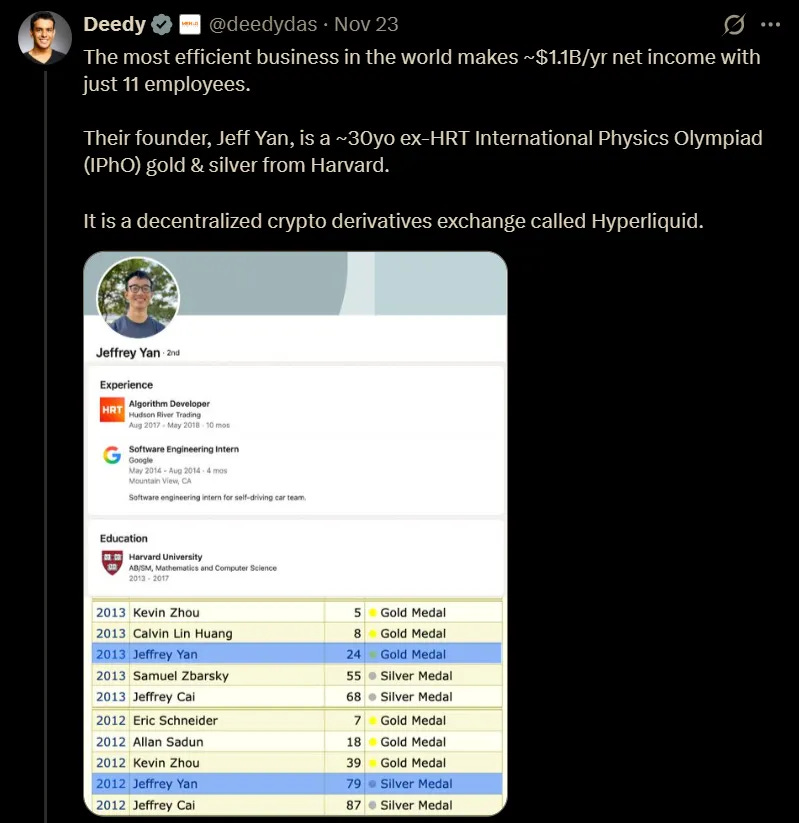

3. The founder: why Jeff Yan looks like an AI-era archetype

Hyperliquid’s structure mirrors the background of its founder, Jeff Yan.

International Physics Olympiad gold medalist

Harvard AB/SM in Mathematics and Computer Science

High-frequency trading engineer at Hudson River Trading

Software engineer at Google

Founder of Chameleon Trading, a major crypto market maker

From HFT, Yan learned how to build ultra-low-latency systems. From Google, he saw how distributed systems scale. From Chameleon, he got capital and an intimate view of market structure across crypto.

None of this is directly “AI,” but it is the same profile you see at the core of serious AI infrastructure projects: deep math, strong systems engineering, and domain expertise.

Bootstrapped, no VC, community-first

Yan funded Hyperliquid with trading profits. There are no venture funds on the cap table.

When HYPE launched:

Around 31 percent of supply went to users via airdrops

Roughly three quarters of total supply is allocated to the community over time

The team takes zero cut of protocol fees; their upside is through tokens and long-term success

The result is a platform that looks and feels more like infrastructure than a startup chasing a funding milestone.

4. Regulation: automated leverage in a human legal system

Hyperliquid’s structure is software-native. Regulation is not.

Jurisdiction and access

The core entities sit in Singapore, with a foundation and affiliated labs.

Key facts:

Official interface blocks U.S. users

Some VPN users identified as U.S. have had funds frozen

Trading is wallet-based, but there are KYC / AML integrations on the backend for specific flows

Hyperliquid has engaged with the CFTC via comment letters about decentralized perp markets

The intent is obvious: operate at global scale while staying out of direct line of fire of U.S. and European derivatives regulations for as long as possible.

Enforcement and AML risk

Chinese authorities have already uncovered money laundering rings that used Hyperliquid’s leverage to move funds. Hyperliquid itself was not charged, but that kind of headline lifts the protocol higher on regulators’ radar.

The main structural risks:

No traditional licenses in major markets

Closed-source code and tight validator control make it easy to argue the system is “effectively centralized”

Retail access to high-leverage derivatives is regulated almost everywhere

For an AI newsletter readership, the key insight is this: when you compress a billion-dollar operation into a small team and a protocol, you also compress the legal risk onto a tiny group of humans.

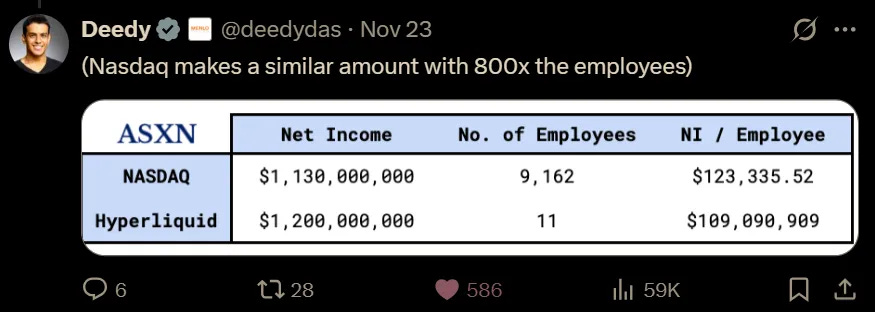

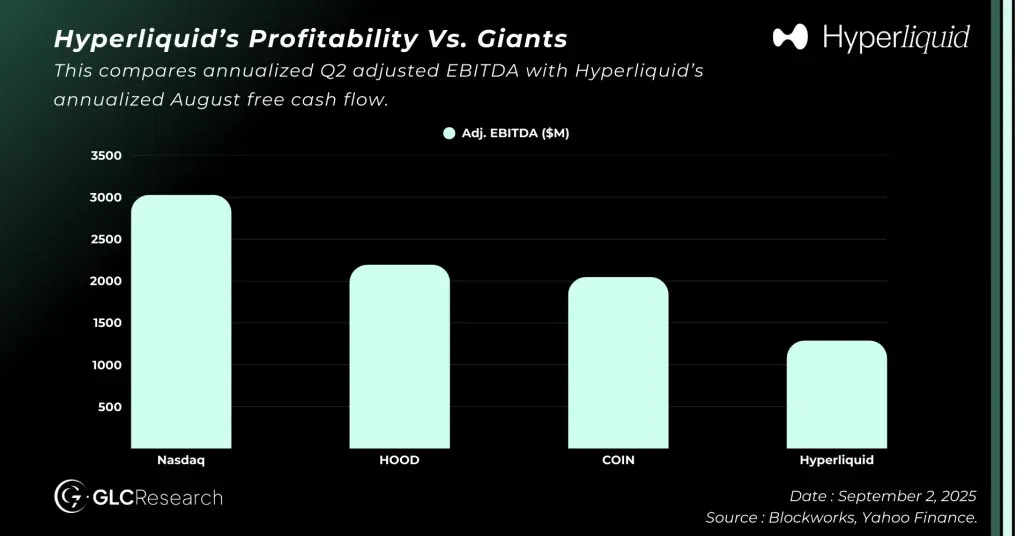

5. Hyperliquid vs NASDAQ and Binance: an efficiency benchmark for AI era systems

Hyperliquid’s metrics are a useful benchmark for any AI or automation project.

Revenue and margin

Hyperliquid revenue: about 1.17 billion dollars annualized

NASDAQ net income: about 1.12 billion dollars in 2024

Binance revenue: around 16.8 billion dollars

Hyperliquid’s costs are so low that most of that revenue would effectively be profit if it were a traditional company.

Revenue per employee

Hyperliquid: about 106 million dollars

Tether: roughly 93 million dollars

Apple and Nvidia: 2 to 4 million dollars

NASDAQ: about 0.8 million dollars

If you are thinking about AI efficiency, this is the number to focus on. Hyperliquid is what a fully automated, software-led financial system looks like when it works.

6. Industry reaction: “proof of concept” or “centralized risk in disguise”?

Admiration

Supporters see Hyperliquid as proof that DeFi and automation can finally challenge centralized exchanges on their own turf.

They point to:

CEX-level UX and latency

Non-custodial, wallet-based control of funds

Massive volume and deep liquidity

Community-first tokenomics with no venture overhang

For traders, Hyperliquid feels like Binance. For DeFi purists, it is at least closer to the trust model they want.

Skepticism

Critics raise three issues:

Centralization. Closed source code, a limited validator set, and admin actions like freezing some accounts do not look like fully decentralized finance.

Regulatory risk. High leverage plus global access plus derivatives is exactly what regulators pay attention to.

Valuation risk. HYPE’s fully diluted valuation has reached tens of billions. Some analysts question whether a single-product protocol can sustain that.

For the AI community, the takeaway is not who is right. It is that once you show what a hyper-efficient, code-only financial system looks like, you force the entire industry to react, including regulators and competitors.

7. Sustainability: is Hyperliquid a new pattern or a one-off?

Hyperliquid’s model comes with obvious questions.

Market and cycle risk

Perp volume is volatile. In a deep bear market, fee revenue can collapse. Hyperliquid is still concentrated in a single line of business.

The payments and settlement narrative could stabilize this if more real-economy flows move across its stablecoin rails.

Competitive risk

dYdX is building its own chain

Binance and other CEXs can spin up copycats

Big fintechs and banks are working on stablecoin and tokenized-asset infrastructure

Hyperliquid’s real moat rests on:

Liquidity

Latency and performance

Brand and community trust

Regulatory and operational risk

A serious regulatory move could change the economics overnight.

A major bug or exploit could test the limits of an 11-person team.

Over time, Hyperliquid will probably have to trade some of its extreme lean structure for more resilience: a bigger team, open-source clients, more decentralized validation, better governance.

What Hyperliquid tells us about AI and the future of work

Hyperliquid is not marketed as an AI product, but it behaves like one:

It takes in a stream of inputs (orders, cancels, margin events)

Runs them through complex logic at high speed

Updates a shared state for millions of users

Does this 24/7 with almost no human intervention

It is a real-world example of what people mean when they talk about AI agents, autonomous systems, and software leverage.

For founders building in AI:

Hyperliquid shows how far you can push automation when you design the system around it from day one.

It illustrates the economics of a service that is mostly “software doing work” rather than “software helping people do work.”

It also shows the tradeoff: efficiency and profit come with concentrated legal and operational risk.

For investors:

Hyperliquid is a live case study for evaluating AI-era companies: look at revenue per employee, degree of automation, and how much of the workflow is code rather than human labor.

It suggests the most interesting AI-native businesses will often look less like SaaS and more like protocols and agents.

Hyperliquid may or may not remain the most profitable exchange in the world.

What is already clear is that it has set a new reference point for what a tiny, intelligent, heavily automated system can do.

In the age of AI, that is the real story.

This was really a great read. Sometimes breaking down a crypto platform like this really gives perspective on the direction of the coin. Just bought more $HYPE token because from your analysis the team knows exactly what they are building.

The last time someone built something this revolutionary was CZ who built

Impressive, but there is nothing related to AI and etc - it’s pure deterministic programmable approach. Classic software development by an outlier team and a strong business thesis.